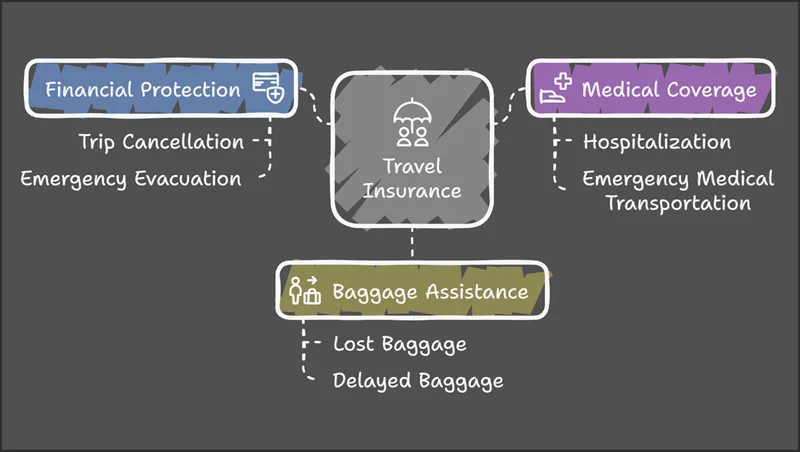

Travel insurance is your safety net when things go wrong on the road. At its core, it’s a policy designed to protect you financially from unexpected hiccups like trip cancellations, medical emergencies, or lost luggage. Is travel insurance worth it? With the unpredictability of today’s travel landscape—think weather delays, airline strikes, or global health concerns—it’s more relevant than ever.

Travel insurance offers more than just financial security. Imagine losing your luggage or facing a medical emergency abroad; insurance ensures you’re covered without derailing your budget. Plus, it provides peace of mind, letting you focus on enjoying your adventure. Whether it’s safeguarding your rental car (Allianz rental car insurance) or comprehensive plans from providers like Blue Cross or Zurich, the right policy can save you from costly surprises.

The Benefits of Investing in Travel Insurance

When you’re planning a trip, travel insurance might feel like an unnecessary expense—especially for budget travelers. But it can save you from major headaches (and costs) if the unexpected happens. Here’s why it’s worth considering:

Protection Against Trip Disruptions

- Trip cancellation and interruption: Whether it’s a family emergency or severe weather, cancel for any reason insurance ensures you get reimbursed for non-refundable bookings.

- Trip delay coverage: Stuck at an airport? Travel insurance covers extra expenses like meals or accommodations during delays.

Medical and Emergency Assistance

- Coverage for medical expenses abroad: Medical bills can skyrocket overseas, and some countries require travel medical insurance (like for a Schengen visa).

- Emergency evacuation services: An evac plan ensures you won’t be stuck without help during serious emergencies.

Baggage and Personal Belongings

- Baggage delay protection: Don’t let misplaced luggage ruin your trip—insurance reimburses essentials while you wait.

- Lost or stolen luggage coverage: Say goodbye to the stress of replacing belongings without breaking the bank.

Additional Perks

- 24/7 emergency assistance: Get help any time, anywhere.

- Concierge services: From booking reservations to coordinating travel changes, these extras make life easier.

With so many benefits, the question isn’t “Is travel insurance worth it?”—it’s “Can you afford to skip it?”

Decoding Coverage

Travel insurance can feel overwhelming, but understanding what’s covered (and what’s not) is essential. Here’s a breakdown to help you make informed choices.

A. Types of Coverage Offered

- Trip Cancellation: Get reimbursed for non-refundable costs if you need to cancel plans for covered reasons, like illness or weather.

- Trip Interruption: Coverage kicks in if your trip is cut short unexpectedly—ideal for emergencies like family crises.

- Medical Expenses: From minor injuries to serious illnesses, travel insurance covers medical costs abroad. Long term travel insurance is great for extended trips.

- Emergency Evacuation: A personal evac plan ensures swift transportation to proper medical care in emergencies.

- Baggage Delay and Loss: Misplaced luggage? Insurance compensates for essentials or lost items.

- Cancel For Any Reason (CFAR): Wondering “Is Allianz trip insurance worth it?” CFAR offers flexibility to cancel without losing your investment.

B. What’s Typically Not Covered

- Pre-existing medical conditions: Unless you’ve added specific coverage, these are often excluded.

- Acts of negligence or self-inflicted injuries: Be mindful—reckless behavior isn’t covered.

- Known natural disasters: Unless listed in the policy, predictable risks may not qualify.

- High-risk activities: Love extreme sports? You’ll need extra coverage to protect against injuries.

Understanding what’s included ensures you won’t face surprises. Whether you’re cruising with Disney travel insurance or exploring the world, knowing the details makes all the difference.

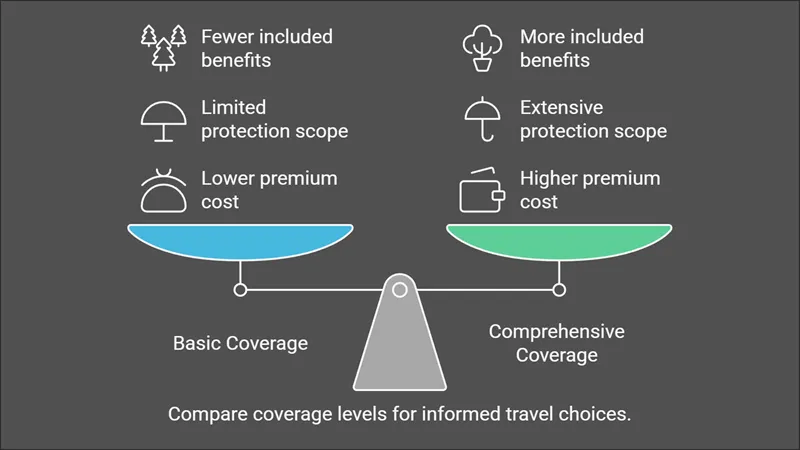

Understanding the Cost

Travel insurance is often more affordable than you might think, and understanding what influences its cost can help you make smarter decisions.

A. Factors Influencing Premiums

- Trip Duration and Destination: The longer and farther you travel, the higher the premium. Trips to high-risk areas, like regions with political instability or natural disaster risks, may cost more.

- Traveler Demographics: Age and health status impact premiums. Older travelers or those with specific health concerns may see higher rates.

- Coverage Level and Add-Ons: A basic plan covers essentials, but comprehensive plans with options like “cancel for any reason” or business travel insurance offer broader protection—for a higher price.

B. Cost-Benefit Analysis

- Weighing the cost vs. potential savings: Use a travel insurance cost calculator to estimate expenses. Compare that to the price of replacing canceled trips, lost baggage, or unexpected medical bills.

- Different trip types: For leisurely vacations, basic coverage might suffice, but adventurous activities or cruises often require robust policies (e.g., Disney travel insurance or NCL cruise travel insurance).

When Travel Insurance is a Must

There are situations where skipping travel insurance simply isn’t worth the risk.

A. Expensive or Non-Refundable Trips

If you’ve invested in high-value vacations or prepaid bookings, insurance can save you thousands if plans go awry.

B. Long-Term or International Travel

Extended trips or visits to multiple countries often require comprehensive coverage, especially for travel insurance for Europe trips or Schengen visa requirements.

C. High-Risk Destinations and Activities

Heading to Mexico during hurricane season or planning an adventure in Japan? High-risk activities or destinations prone to natural disasters or instability make insurance essential.

By understanding the costs and identifying when insurance is crucial, you can travel with confidence—knowing you’re covered no matter what.

When You Can Skip

While travel insurance is a wise choice in many cases, there are times when you might safely skip it.

A. Short, Low-Risk, or Domestic Trips

If you’re flying domestically or taking a short, low-risk trip, domestic flight insurance or coverage for travel insurance for domestic travel might not be necessary. With fewer risks involved, you may not need the extra expense.

B. Fully Refundable Bookings

If your bookings are fully refundable, you already have flexibility in canceling or changing plans without financial loss. In these cases, insurance may not provide much-added value.

C. Existing Coverage

Double-check your existing credit card or health insurance policies. Many credit cards offer trip protections or emergency medical coverage, eliminating the need for additional travel insurance.

How to Choose the Perfect Policy

Finding the right policy doesn’t have to be overwhelming. Here’s how to narrow down your options:

A. Assessing Personal and Trip-Specific Risks

Are you traveling while pregnant or visiting high-risk destinations? Look for specialized options like pregnancy travel insurance or policies for adventurous activities. Tailor your plan to your needs.

B. Comparing Policies and Understanding Terms

Don’t settle for the first option. Compare plans, like Europ Assistance travel insurance or best cruise ship travel insurance, to find the best coverage and price.

C. Reviewing Policy Options and Exclusions

Always read the fine print. Understand what’s excluded, such as pre-existing conditions or high-risk activities, to avoid surprises.

D. Tips for Purchasing Travel Insurance

- Buy early to ensure full coverage, especially for benefits like “cancel for any reason.”

- Match your policy to your trip type, whether it’s travel insurance for pregnant women or multi-country coverage.

By understanding your needs and comparing options, you’ll feel confident choosing a plan that fits both your trip and budget.

Beyond Traditional Insurance: Exploring Alternatives

If you’re not ready to commit to traditional travel insurance, there are alternative options worth considering.

A. Credit Card Travel Insurance

Many credit cards offer travel insurance benefits as part of their perks.

- Pros: It’s convenient—coverage is automatic when you book using the card. Plus, it can save money compared to buying a standalone policy.

- Cons: Benefits are often limited. For example, coverage for trip cancellation or medical emergencies may not be as comprehensive as a dedicated travel insurance plan. Always read the fine print.

B. Self-Insurance Options

If you’re confident in managing risks, you might consider self-insurance.

- Set aside a small emergency fund for potential travel mishaps. While it requires discipline and foresight, it can work for seasoned travelers who rarely encounter issues.

Assessing the Value: Is Travel Insurance Right for You?

Deciding whether travel insurance is worth it boils down to evaluating your specific needs.

A. Weighing the Pros and Cons

Ask yourself: Do you have expensive non-refundable bookings? Are you traveling to high-risk destinations? For example, if you’re wondering is Airbnb travel insurance worth it, consider the value of your stay and cancellation policies. Or if you’re debating is Allianz trip insurance worth it, weigh its comprehensive coverage against the cost.

B. Making an Informed Decision

Ultimately, the right choice depends on balancing costs against potential risks. If your trip involves significant financial investment or unique risks, insurance provides peace of mind. For budget travelers, it’s about choosing just enough coverage to avoid big losses while staying within your means.

Top-Rated Travel Insurance Providers

Choosing the right travel insurance provider can feel overwhelming, but understanding the options can simplify the process.

A. Overview of Leading Companies

Here’s a quick look at some top-rated providers:

- Royal Caribbean: Ideal for cruise-goers, offering tailored plans for medical emergencies and cancellations specific to cruises.

- Carnival Cruise: Provides comprehensive coverage for trip interruptions, cancellations, and onboard emergencies, making it a favorite among cruise enthusiasts.

- Discover: Known for its wide range of plans, including coverage for leisure, business, and family travel, with competitive pricing and excellent customer service.

B. Comparing Providers

When comparing these options, consider what matters most for your trip:

- Strengths: Cruise insurance policies focus on activities and risks unique to sea travel. General providers like Discover offer broader flexibility.

- Weaknesses: Cruise-specific plans may not cover activities off the ship, while broader plans might overlook cruise-specific risks.

Evaluate each provider’s unique features to ensure the best fit for your needs.

Travel Insurance Essentials: Frequently Asked Questions

It’s natural to have questions about travel insurance. Here are some answers to the most common ones.

A. Common Inquiries Addressed

- What does travel insurance cover? Coverage typically includes trip cancellations, medical emergencies, and lost baggage, though specifics vary by provider.

- How do I file a claim? Most insurers have simple online claim processes. Be sure to save all receipts and documentation.

- Is travel insurance expensive? Costs vary but typically fall between 4-10% of your trip cost. Use a travel insurance cost calculator to estimate.

B. Clarifying Misconceptions

- Myth: Travel insurance isn’t necessary for domestic trips.

- Fact: Even domestic travel can involve risks like medical emergencies or weather-related disruptions.

- Myth: Travel insurance always covers everything.

- Fact: Policies often have exclusions, so always review the fine print.

With a better understanding, you can choose the coverage that works for you!

Conclusion

While travel insurance is an important consideration for budget travelers, it’s just one piece of the financial puzzle. Whether it’s worth the cost depends on your trip and comfort level, but one thing is certain: smart budgeting is the foundation of any affordable adventure. Imagine taking control of your travel expenses with a trip budget calculator—a simple tool that maps out your costs and highlights where you can save. It’s a game-changer for stretching your dollars further and traveling with confidence. Want to master the art of wallet-friendly travel? Dive into our Ultimate Guide to Wallet-Friendly Trips for expert tips, including how to use a budget calculator like a pro. Empower yourself to explore more for less—your next budget-savvy getaway starts here!